A better way to bank

Everything you need to manage your money on your phone.

Get Renasant Rewards Extra

Are you ready for Extra? Check balances, access more than 450,000 nationwide deals, control your cards, manage your money, and more.

Control your finances.

With Renasant Mobile Banking, you may never need to carry cash again.

Follow the flow of your finances.

Set spending limits.

Get only the notifications you know you need.

Turn your debit card on or off with a swipe.

Bank from anywhere.

Your bank’s most convenient branch is the one closest to you. With Renasant Mobile Banking, that’s always as near as your phone.

- Use Mobile Check Deposit to process physical checks from practically anywhere. Your phone is the only bank you’ll need.

- Through Zelle®, you can send and receive payments from your friends and family using almost any US-based bank account right from your phone.

- With Online Bill Pay, you can handle all of your monthly obligations with ease.

With the Renasant Mobile App, your bank is always at your fingertips. Manage your accounts, check balances, make transfers, pay bills, deposit checks from your phone and more.

Send and receive person-to-person payments that are more convenience than cash.

The Renasant Mobile App brings together all the best in mobile banking, all in one place. More convenient than cash

Renasant is proud to bring you Zelle, a new way to send and receive money between almost any U.S. bank accounts in minutes. Securely move money through the mobile banking app you already use and trust. Zelle is quick, easy and requires no special set up.

With your phone’s camera and the Renasant Mobile App, you have all you need to deposit physical checks immediately. The app walks you through the process. Just capture images of the front and back of the checks you receive, confirm the amounts, hold onto the checks for 5 days after the deposit is posted and you’re all set.

With the Renasant Mobile App, you can pay your bills online with a touch fo the screen. No checks to write, no payments to mail, nothing to hold you up or tie you down. As always, the service is free, simple and easy to use, making the monthly chore a breeze.

Get Rewards Extra +

Send and receive cash.

Transfer money between almost any U.S. bank account within minutes with Zelle®, send and receive money from virtually anywhere.3

- Convenient, fast, easy

- No transaction fees

- Transfer with a touch

Renasant Bank customers have all the best options for fast and convenient access to their money. From contactless payments with merchants to receiving and sending money among friends, we’ve gathered all the best features in one place. Our banking experience allows you to eliminate the hassles and handle your finances from almost anywhere.

- Quickly transfer money between your Renasant accounts.

- Bills, balances, deposits and payments all flow through one place.

- There’s never a fee to make or schedule a transfer or payment.

- Use Zelle® to send and receieve money with friends and family.

Deals that discover you.

With Renasant Mobile App connected to your Renasant Rewards Extra checking account, tap into more than 450,000 deals and discounts nationwide.

- With more than 450,000 shopping discounts built in, Renasant Rewards Extra Checking connects you to opportunities you’d never have known were there.

- Find special dining delights at restaurants.

- Explore and save at local retail stores.

With more than 450,000 shopping discounts built in, Renasant Rewards Extra Checking connects you to opportunities you’d never have known were there.

Find special dining delights at restaurants.

Explore and save at local retail stores.

Get Rewards Extra

Avoid the worry.

Renasant Rewards Extra Checking has perks and insurance to help customers handle many of life's mishaps. We like to think of it as the checking account that checks all the boxes.

- Cell phone protection

- Roadside assistance

- Identity Protection

- Travel accidental death insurance

- Buyer's Protection and Extended Warranty

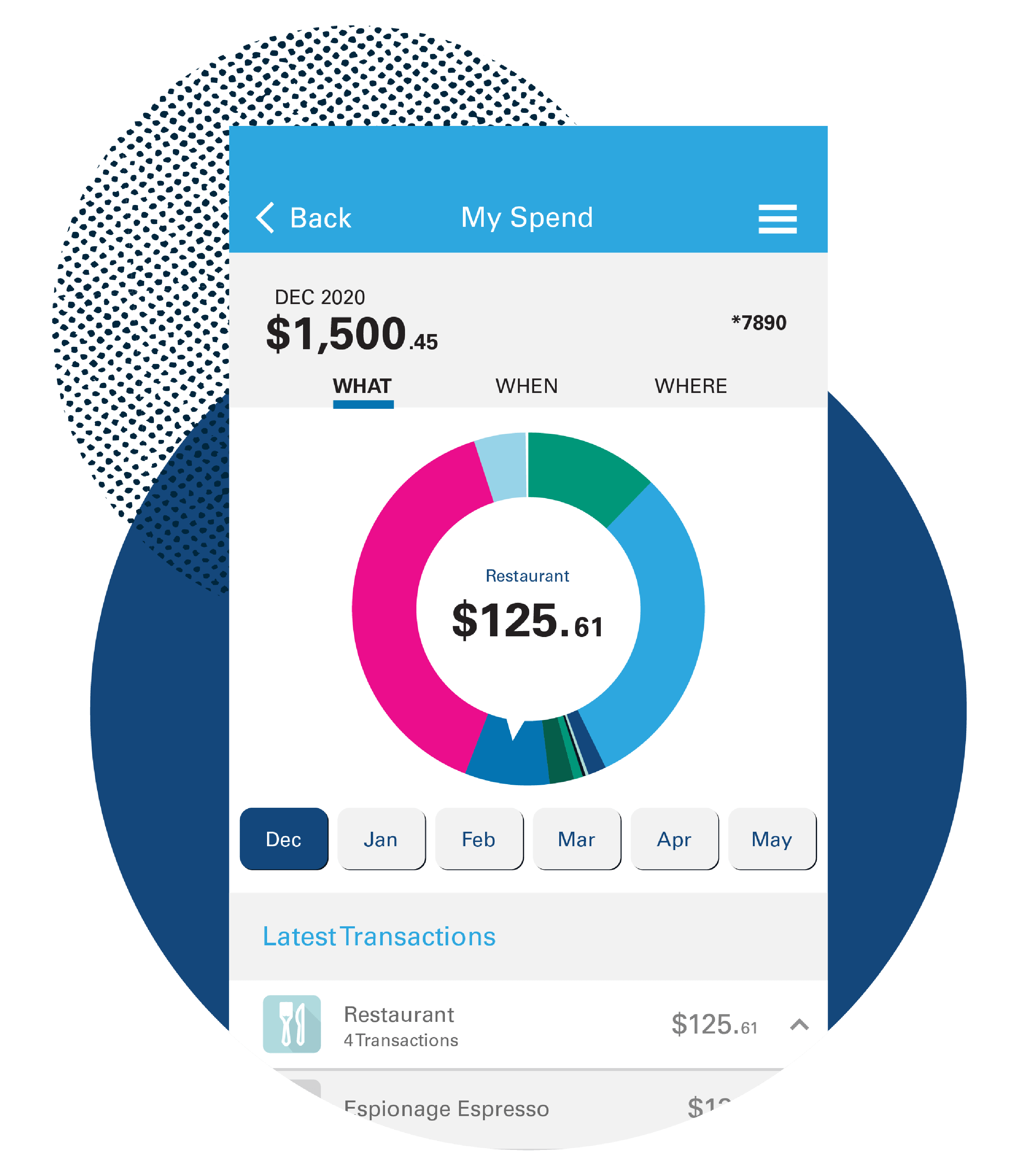

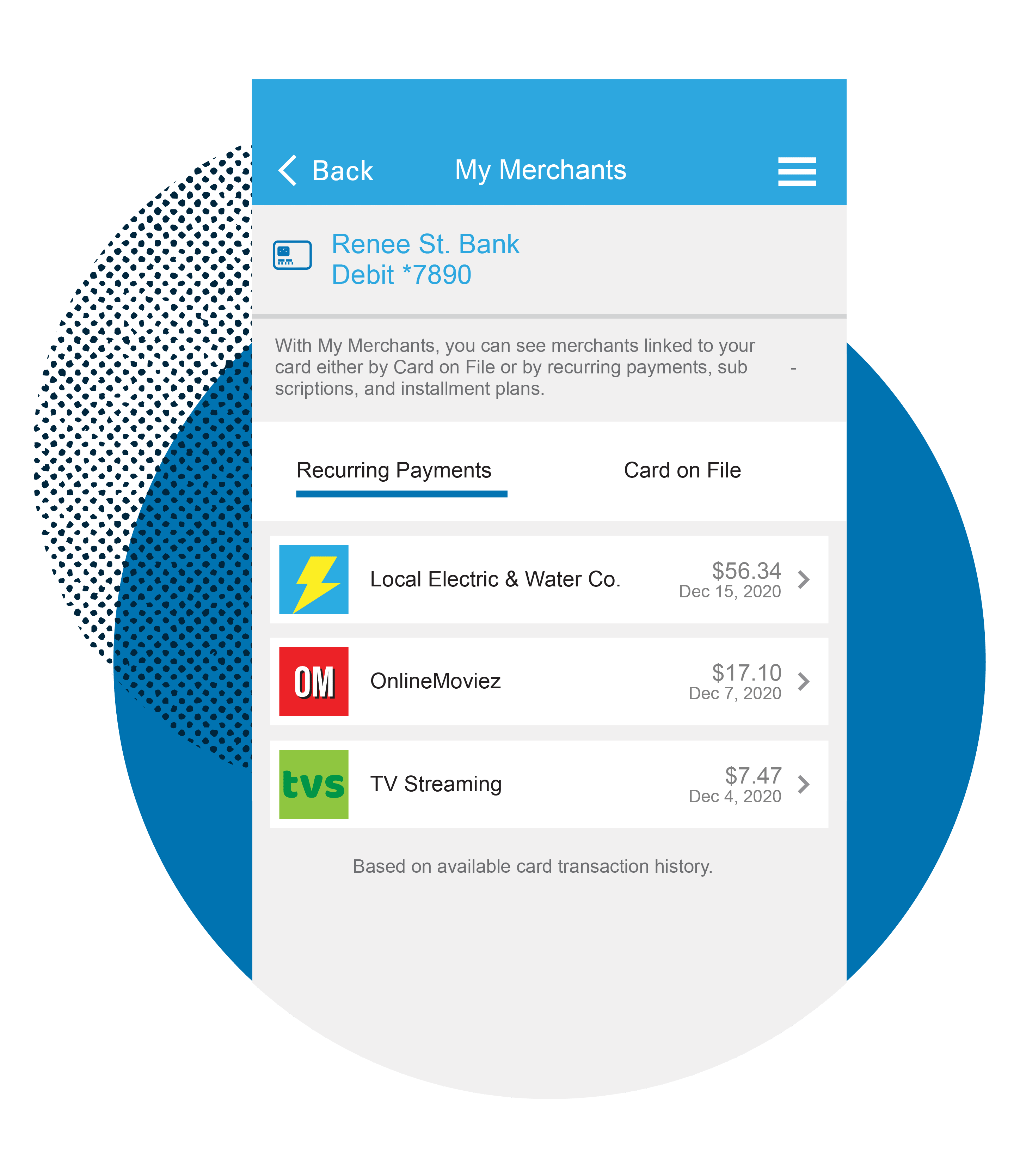

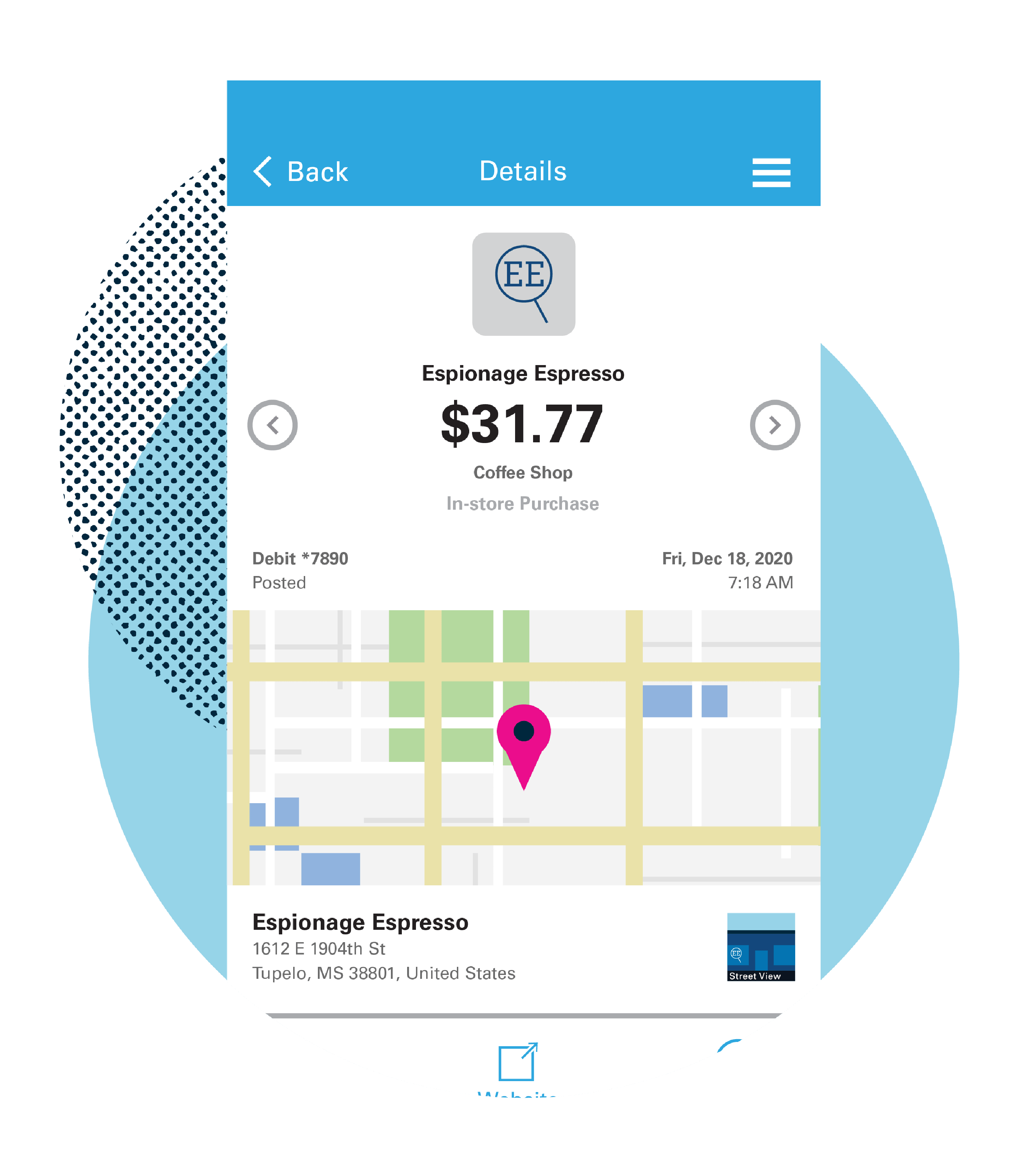

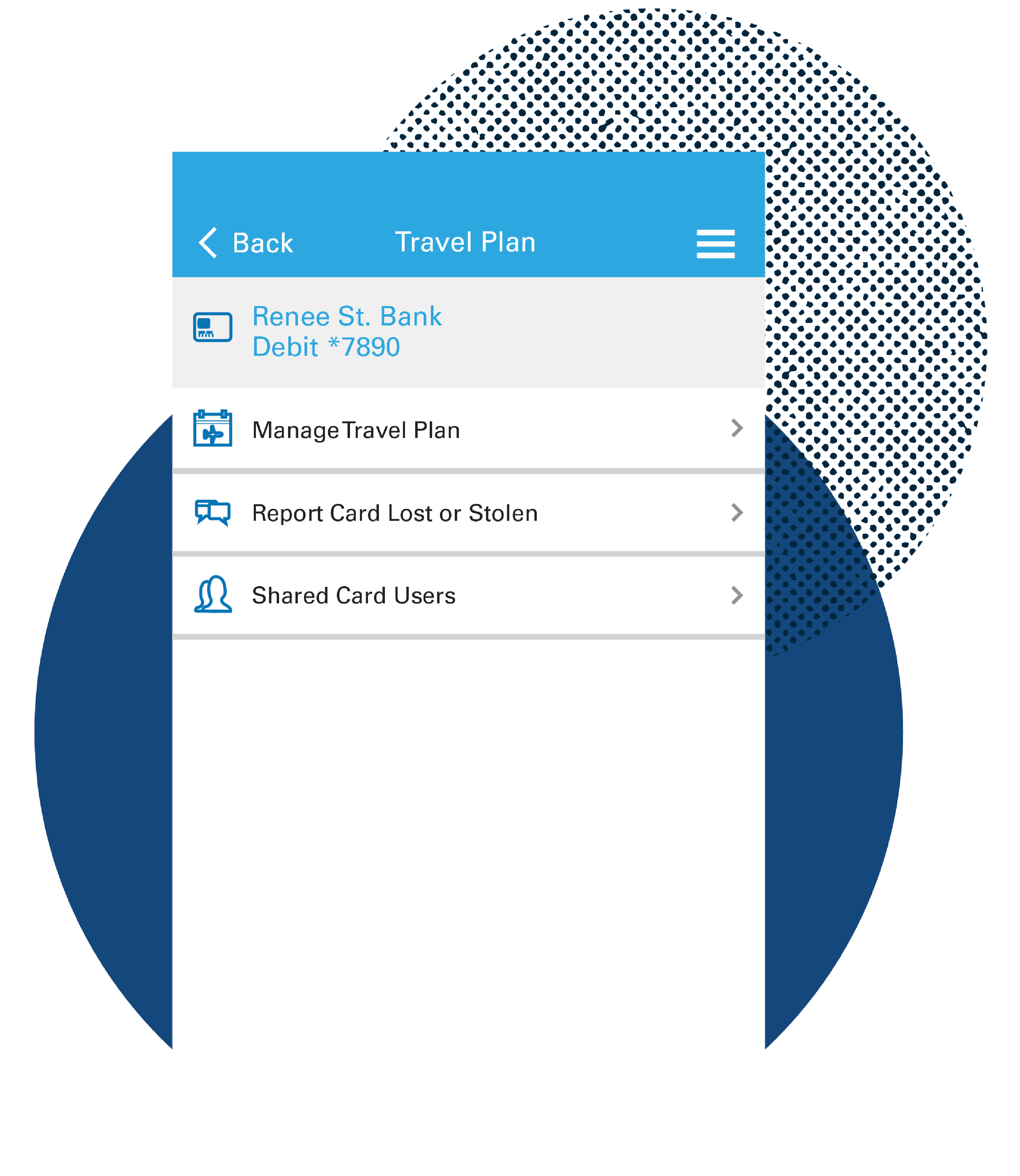

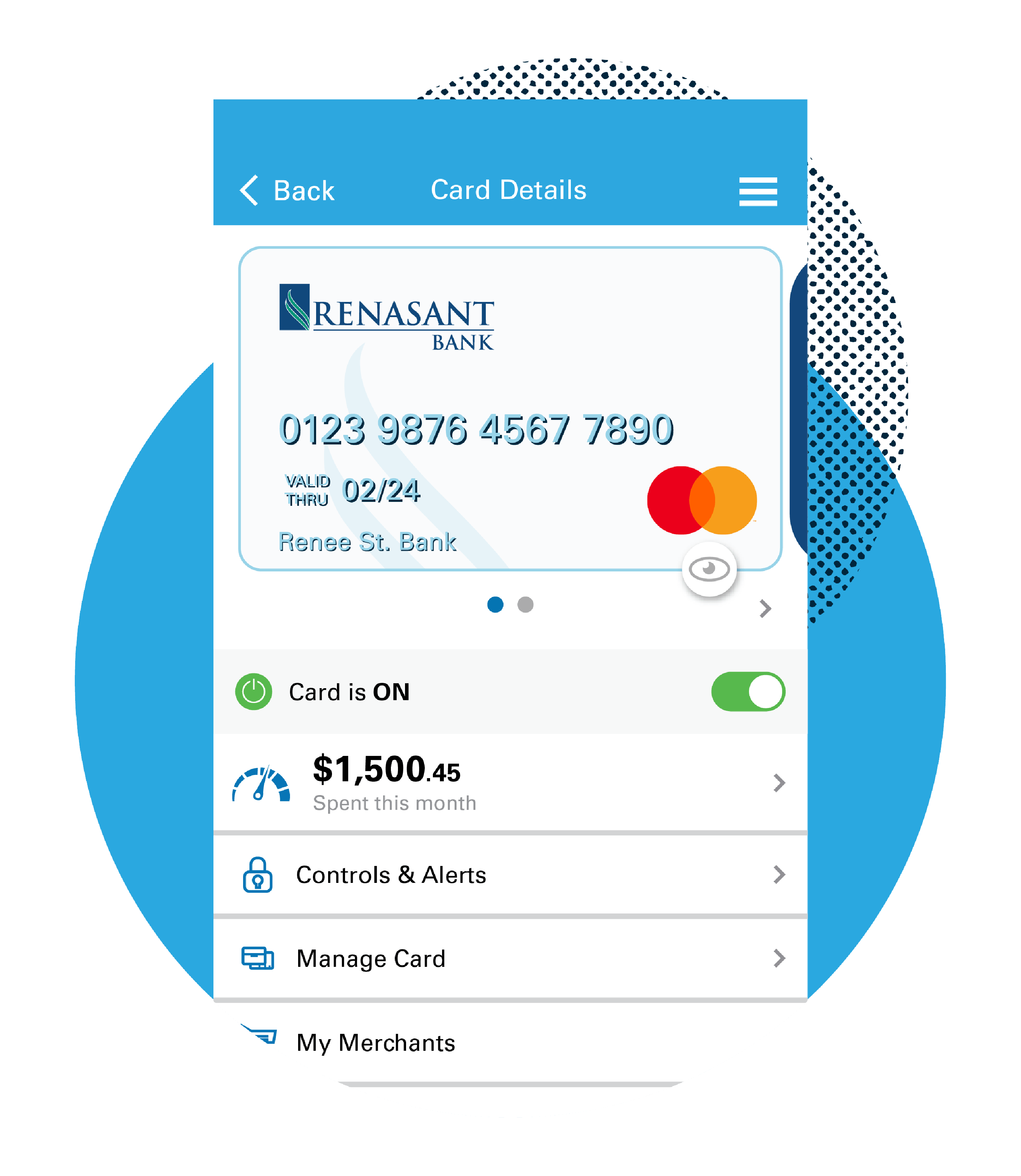

Take complete control of your debit card and take command of your financial life with the Renasant Card App. It has all the best tools to control your finances from your phone, no matter where life takes you.

- Set spending limits and alerts.

- Turn debit cards on/off if misplaced, lost or stolen.

- Get spending insights by month, merchant category, location and more.

- Consolidate all of your recurring transactions and keep up with where your card information is stored online.

To get started, just open your Renasant Mobile App, tap the Renasant Card App banner, and you're on your way!

More about the Renasant Card App

Track spending in real time.

Know where your money is.

Fight against fraud.

Plan ahead.

React in real time.

Rewards Extra Checking has a cell phone protection plan for those unexpected accidents.7,8

Unexpected vehicle issues can leave you stranded and take a toll on your wallet.7

Choose Renasant Bank Rewards Extra Checking and receive discounts from our partners.7

$2,500 in personal identity theft benefits and identity restoration services.7

Necessary coverage to keep your family protected in worst-case scenarios and unexpected accidents.7,8

Help you save money on prescriptions, eye care, and hearing services.7

When you sign up for a Rewards Extra Checking account with Renasant Bank, you get our Extra perks. These come in addition to these great features:

- Low opening balance of $50

- Renasant Debit Mastercard®

- Up to $20 in ATM fee refunds per monthly statement period

- Access to the Renasant Mobile Banking App

- Intuitive online banking services like Online Bill Pay

- Higher interest earned on balances up to $25,000

- Balances over $25,000 earn a lower but competitive rate

Earn the higher interest rate on balances up to $25,000 and up to $20 in ATM fee refunds per monthly statement period when eligibility requirements are fulfilled.

Eligibility Requirements:

- Have at least 10 debit card transactions (excluding ATM transactions) post and clear per Qualification Cycle9;

- Have at least one direct deposit or ACH automatic payment post and clear per Qualification Cycle9, and;

- Receive your monthly statement electronically.

Convenience in the palm of your hand.

Contact-Free Transactions

Make your transactions contact-free when you choose Apple Pay® or Google Pay™.4,5

Zelle®.

Send and receive money directly with friends and family through the mobile banking app you already use and trust.3

Click to Pay

Make all your purchases and keep your day moving, all from one account with Click to Pay.6

Google Pay with Renasant is a fast and easy way to pay with your Android™ phone or tablet. By adding your Renasant Bank Mastercard® Debit Card or Renasant Bank Visa® Consumer Credit Card to the Google Pay app, you can utilize this innovative feature that saves time and helps keep your account details secure. Google Pay is accepted at a variety of online and in-store retailers.

Your Renasant Bank Mastercard® Debit Card works with Apple Pay®. Making a purchase is easier than ever—all it takes is a simple touch of your iPhone 12 Pro Max, iPhone 12 Pro, iPhone 12, iPhone 12 mini, iPhone 11 Pro Max, iPhone 11 Pro, iPhone 11, iPhone XS, iPhone XS Max, iPhone XR, iPhone X, iPhone 8, iPhone 8 Plus, iPhone 7, iPhone 7 Plus, iPhone 6, iPhone 6 Plus, iPhone SE, iPad Pro, iPad (5th generation), iPad Air 2, iPad Mini 4, iPad Mini 3, MacBook Pro with Touch ID, A Mac model introduced in 2012 or later with an Apple Pay-enabled iPhone or Apple Watch, Apple Watch Series 3, Apple Watch Series 2, Apple Watch Series 1 and Apple Watch (1st generation).

Not only are payments quicker with your Renasant Bank Mastercard Debit Card and Apple Pay, they are secure. Your information no longer needs to be handed over to complete a transaction. There is even a feature to disable Apple Pay if your device is ever lost or stolen.

Your privacy is a high priority for us. You can use Apple Pay with ease of mind because your purchases are not tracked or saved by Apple.

Renasant is proud to bring you Zelle, a new way to send and receive money between almost any U.S. bank account in minutes.* Securely move money through the mobile banking app you already use and trust. Using Zelle is quick and easy and requires no special set up. As a Renasant client, you already have access to Zelle without the hassle of downloading a new app or giving away your personal information to another company.

Make all your purchases and keep your day moving, all from one secure account with Click to Pay.

Paying with Click to Pay makes your purchases quicker. From one secure account, you can make all the purchases you want to keep your day moving. No information needed. With features like tap and pay, promotions and exclusive deals, and the ability to use at retailers worldwide, the ease and convenience is at your fingertips.

Get Rewards ExtraOpening a Renasant Rewards Extra account is simple, quick and can be opened entirely online. Tap into all the benefits of a better way to bank. Open an account today.

Get Rewards Extra-

Renasant Online Banking, eStatement, Mobile Banking, and Text Message Banking applications are available to all Renasant Bank consumer online banking customers. Bill Pay and Funds Transfer features of our suite of online products are available when there is sufficient available balance for the transfer or bill payment.

-

Because it is of utmost importance to protect your personal information, we go to great lengths to make sure that your transactions are confidential and secure when you are banking online. Renasant Online Banking and its related bank products use encryption technology and other security measures to protect the confidentiality of transactions. Although we work hard to ensure the security of our systems, it is equally important that you take appropriate steps to protect the matters within your control, such as protection of user names and passwords, anti-virus and spyware software for your computer, and avoidance of phishing email messages. Click here for more security information and tips.

-

Must have a bank account in the U.S. to use Zelle®. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. If the recipient is not yet enrolled with Zelle® it may take between 1 and 3 business days after they enroll. Dollar and frequency limits apply.

Zelle® is intended for sending money to family, friends and people you know and trust. If you are unsure of a recipient’s email address or mobile phone number, before using Zelle® to send money to that person, you should contact the recipient to confirm the information.

We will send you an email alert with delivery detail immediately after the payment is made. Once a payment is made, you can only cancel the payment if the recipient hasn’t yet enrolled with Zelle®. If your recipient has already enrolled in Zelle®, money is sent directly to your recipient’s bank account and cannot be canceled.

Zelle® does not offer a protection program for any authorized payments made with Zelle®, for example, if you make a purchase using Zelle® but you do not receive the item or the item is not as described or as you expected.

-

iPhone® and iPad® are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Apple Pay, Apple Pay Cash, Apple Watch, Touch ID, and iPad mini are trademarks of Apple Inc.

-

Google Play, Android, Google Pay and other marks are trademarks of Google LLC.

-

The Click to Pay icon is a trademark owned by EMVCo, LLC.

-

Benefits are provided by third party providers arranged and compensated by Renasant Bank. Benefits are subject to additional terms and conditions.

-

Insurance products are: NOT A DEPOSIT. NOT FDIC-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE BANK.

-

Qualification Cycle: This term means a period beginning three (3) business days prior to the beginning of your statement cycle and ending three (3) business days prior to the end of your statement cycle.

-

Offer good on personal accounts only; business and corporate accounts do not qualify for these plans.

-

Certain terms, conditions and exclusions may apply. Consult with a Renasant Bank personal banker, or refer to the Truth In Savings disclosure, for information regarding specific products.

-

Renasant Bank debit cards are offered through Mastercard. Mastercard is a registered trademark of Mastercard International Incorporated.